Blog

A landscaping bond is a type of business service bond that protects your clients from theft or fraud by employees....

A moving company bond is a surety bond that protects your customers if an employee steals or damages their belongings....

A janitorial service bond is a type of surety bond that protects your clients if an employee steals or commits...

A pest control service bond is a type of surety bond that guarantees pest control businesses will operate legally and...

Texas enforces strict weight laws on every road and bridge. You need a permit and a $15,000 bond to haul...

Every year, Texas truckers and trailer owners face hefty fines due to improper weight distribution on a trailer. Misloading can...

Texas is one of the best states to start a trucking company, thanks to its booming economy, central location, and...

A real estate notary plays a crucial role in property transactions, ensuring that documents like deeds, mortgage agreements, and loan...

A notary bond is a crucial requirement for becoming a notary public in Arizona. It serves as a financial guarantee...

Becoming a notary public in Arizona is a great way to provide essential services in legal, financial, and business transactions....

Becoming a mortgage notary in Arizona is a great way to enter the real estate industry while enjoying flexible work...

Truck weight limits are strictly regulated in Texas to protect roads, ensure public safety, and maintain fair industry practices. Exceeding...

Transporting oversize or overweight loads in Texas requires compliance with Texas DOT regulations to avoid fines and delays. Proper permits,...

Proper axle weight distribution is essential for road safety and legal compliance. Overloaded axles can lead to fines, vehicle damage,...

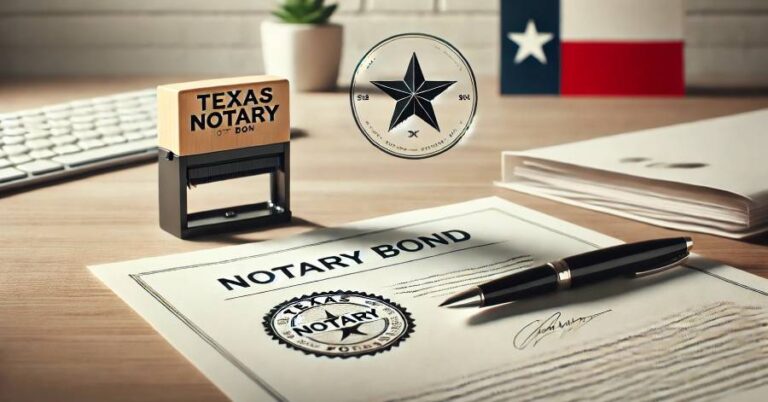

What is aNotary Bond? The Essential Guide to Prevent Risk What is a Notary Bond? Discover the importance of notary...

Discover the cost of a $10,000 notary bond in Texas. Texas law requires notaries to purchase this bond to protect...

Discover the key differences between signature guarantee vs notary. Our guide covers how each service works, uses, costs, and benefits....

Discover what a rider to a notary bond is and why you might need one in Texas. Get info on...

Explore the key differences between a loan signing agent vs notary public. Discover how each role notarizes documents and why...

Discover how to become a notary in Texas. This guide gives you actionable steps and advice to start your career....

Learn how to become a real estate notary in Texas. Follow easy steps to get licensed, secure your notary bond,...

Find out where to get a surety bond for notary in Texas fast. Learn trusted providers, costs, and steps to...

Learn how to become a real estate notary in Texas. Follow easy steps to get licensed, secure your notary bond,...

Discover the key differences between notary bonds vs E&O insurance. Find out how each coverage safeguards notaries and their clients....

In Texas, a vehicle title is crucial for legally registering and proving ownership of a car. But what happens if...

If you’ve lost your boat’s title or are facing ownership disputes, obtaining a bonded title might be the solution. In...

A car title proves ownership of your vehicle, making it essential for registration, selling, or transferring ownership. Losing it can...

Receiving a Notice of Determination for a Bonded Title can be a pivotal moment in securing legal ownership of your...

Losing your car title in Texas can be stressful, as it’s essential for proving ownership and completing transactions. Without it,...

Understanding the difference between a bonded title and an abandoned title is crucial for anyone dealing with vehicle ownership issues...

Are you considering buying a car with a bonded title in Texas and wondering if it’s a safe investment? A...

Transferring a car title after the owner’s death in Texas is crucial yet complex. Understanding the steps involved ensures a...

Ever wondered what happens when you don’t have a title for your vehicle? Understanding bonded titles is crucial for vehicle...

How to Renew an Auto Dealer Bond in Texas (6 Easy Steps) Renewing an auto dealer bond is essential for...

How to Get an Auto Dealer Bond in Texas (7 Easy Steps) Auto dealer bonds are essential for Texas car...

How to Cancel an Auto Dealer Bond in Texas (6 Easy Steps) Understanding how to cancel an auto dealer bond...

Auto Dealer Bond vs Dealer Insurance What’s the Difference? Auto Dealer Bonds and Auto Dealer Insurance are essential for running...

How to Lower Auto Dealer Bond Costs11 Top Tips to Save Reducing the cost of auto dealer bonds can significantly...

10 Reasons Why Auto Dealer Bonds Increase in Texas Texas auto dealer bonds are crucial for ensuring that dealerships operate...

How to Avoid Auto Dealer Bond Claims in Texas (10 Top Tips) Ever wondered how a single bond claim could...

Auto Dealer Bonds: The Essential Guide for Dealerships Ever wondered why the Texas Motor Vehicle Dealer Bond is a big...

How to Make a Claim Against a Car Dealer Bond in Texas Have you ever wondered what happens when things...

Table of Contents Have you ever wondered what a surety bond is and why you might need one? A surety...

Texas Surety Bond Expertise TMD Surety Bonds, a leading provider of surety bonds in Texas, is proud to announce that...

Here’s what you need to know about the cost, purpose, process, and other considerations in obtaining a mixed beverage sales...

Each year, the state of Texas issues over axle and/or over gross weight tolerance permits for commercial vehicles transporting divisible...

When an insurance company denies a claim, homeowners may seek the assistance of a public insurance adjuster to help them...

Contractors who want to work in the city of Midland must register with the city before they begin building or...

The Planning and Development Department for the city of Forth Worth requires contractors to purchase a surety bond to cover...

The city of Austin takes sidewalks seriously. In 2015, the city faced a significant sidewalk problem. Not only was the...

The city of Amarillo requires the purchase of contractor license bonds for specific types of work. A contractor license bond...

A recent study showed that over 50% of small businesses are sued each year. Such litigation can be expensive, ranging...

In the city of Dallas, property owners are required by law to maintain the sidewalks, curbs, gutters, and driveway approaches...

The city of Abilene Department of Building Inspections mandates the purchase of a contractor’s bond for several different contractor categories....

Applying for a city of Austin right of way (ROW) permit can be a daunting task, but it doesn’t have...

If you are building or renovating property in Galveston, you must register with the city before you begin the work....

Title bonds in regard to cars and other road vehicles are pretty common knowledge, but not many people know that you...

When putting together your business’s risk management portfolio, you will naturally need to include commercial insurance as part of your...

If you own a moving company or storage facility, then your clients are going to put a lot of trust...

What are fidelity bonds? All businesses have an obligation to protect their customers, but they also need to protect themselves....

No two surety bonds are the same, nor are their prices. Depending on your surety bond and the percentage you...

Many bonds that businesses can buy are designed primarily to protect third parties, such as contractor bonds and performance bonds. An employee dishonesty...

There are many types of surety bonds available for purchase. Each will apply to different liabilities that various businesses, notably...

Buying and selling cars is a high-stakes transaction. These deals must occur within the boundaries of the law. If someone...

Unlike when you purchase an insurance policy, a surety bond is not something you pay monthly premiums on in exchange for coverage....

When developing a trustworthy business, you have a lot of things to think about. A welcoming working environment and fair...

When signing contracts with clients, you might have to buy surety bonds. They reassure clients that you will meet your contractual...

When hiring employees for your business, you take all the necessary precautions to make sure those employees are trustworthy and...

Surety bonds are useful but confusing, as there are many different types that each serve a different purpose. Some surety bonds...

Performance bonds are typically required for contractors in order to complete a job. A client may hire a contractor for a...

A big similarity between bid bonds and performance bonds are that both frequently apply to construction projects. They also both...

There are various types of surety bonds created for different purposes. Perhaps the most common bond people are aware of are title...

Dishonesty bonds are surety bonds tailored to protect businesses against employee theft. Although you try to vet your employees as much...

At TMD Surety Bonds our number one priority during the unprecedented time of COVID-19 is to the safety of our employees,...

Surety bonds are required in certain circumstances for different individuals and entities. Most surety bonds must be purchased by individuals...

No two surety bonds are the same, nor are their prices. Depending on your surety bond and the percentage you...

SURETY BOND CLAIMS SIMPLIFIED: WHAT THEY ARE AND HOW THEY WORK Ever found yourself tangled in the complex web of...

Bonds are a confusing topic. There are surety bonds for various purposes, one of which is for vehicles. A title bond—also known as...

If your business needs a surety bond, you may be concerned about how much it will cost. Businesses already have to...

Surety bonds are most simply defined as follows: Party A (the principal) promises to do a job for Party B...

Surety bonds have become vital to businesses of all sizes — and across many industries. They let customers hold businesses...

Get Started

Leo semper aliquet conubia nam aenean non iaculis egestas condimentum cursus nascetur, dignissim at imperdiet maecenas dapibus convallis tempus aliquam primis tincidunt faucibus, ultrices potenti quis mattis.